Business Energy Broker

What are non-commodity energy costs?

Non-commodity energy costs take up a large proportion of your energy bill for both gas and electric supplies and your bill is made from this and the commodity cost. The commodity is your energy, the raw material, which is supplied per your demand. If you imagine how you are supplied with gas it’s easy to imagine – there is the physical natural gas that is transported through a pipe line and then through your meter – this is the commodity, the gas. The non-commodity is everything other than the commodity – so this includes the meter, customer services, the pipe line network, and government levies (fees to support reform in the industry).

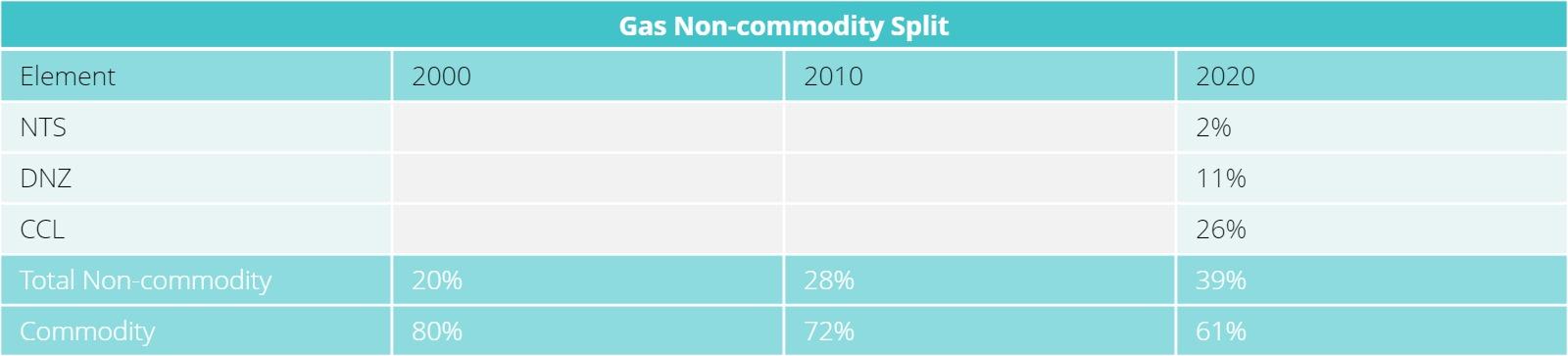

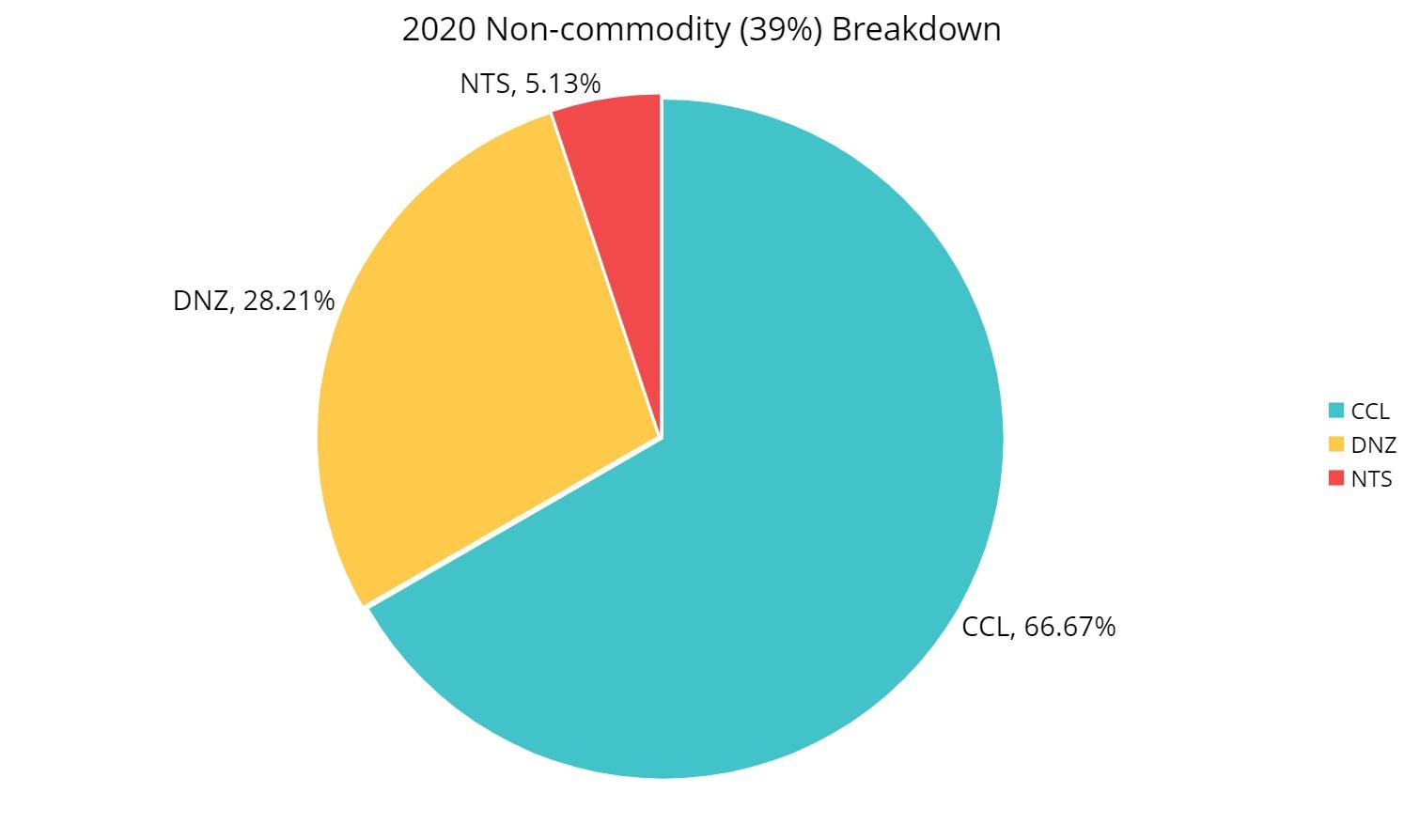

The proportion of non-commodity is always increasing and is due to increase further with government levies to make the UK a net-zero country. Here we can see the increase of the proportion of non-commodity energy costs for the supply of gas over three decades:

The supply of electricity also requires non-commodity energy costs although it is not physical, as it is a current; you still need physical raw materials to produce it such as coal, oil, and gas or wind, nuclear, and solar. The cost of the raw materials and generation is combined to make the commodity cost as this is the cost to get that electricity produced. The non-commodity for electricity is the meter, use of the national grid, distribution in local networks, admin fees, customer services, government levies, etc.

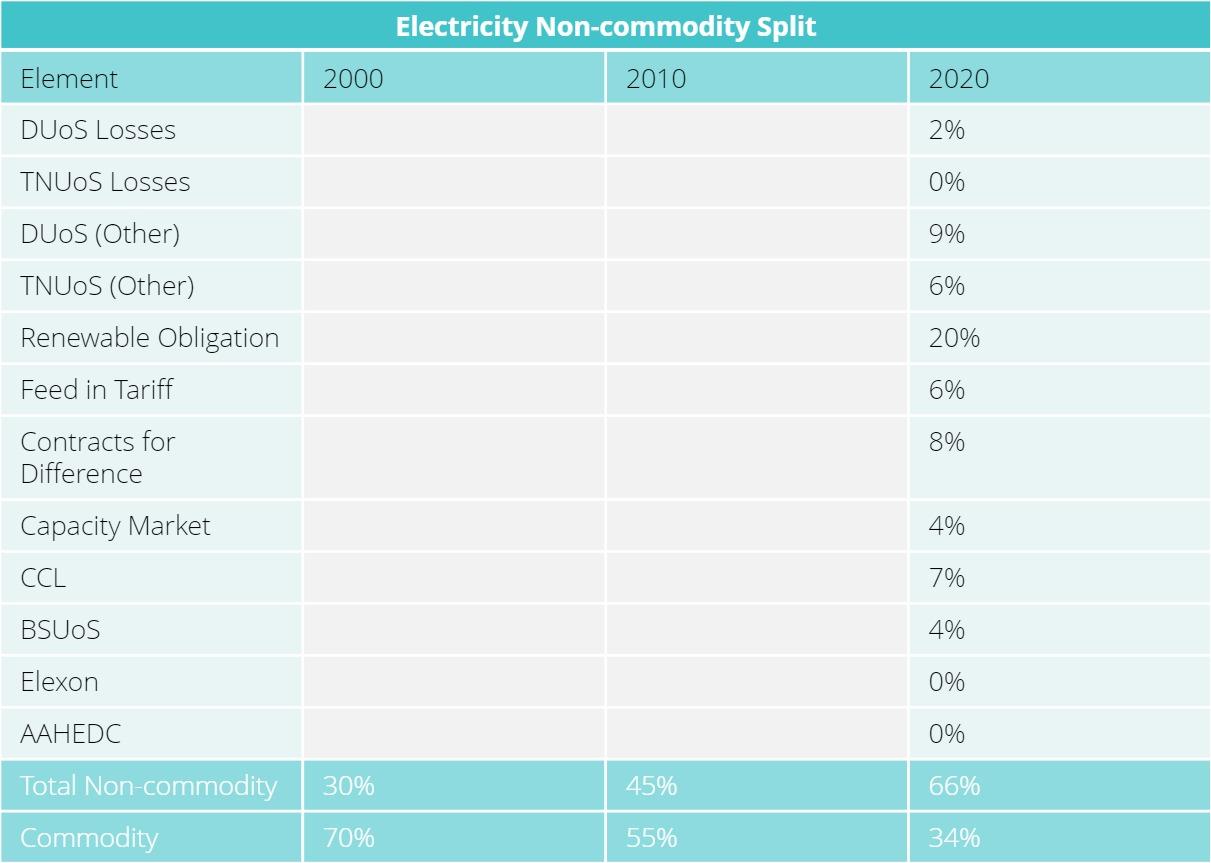

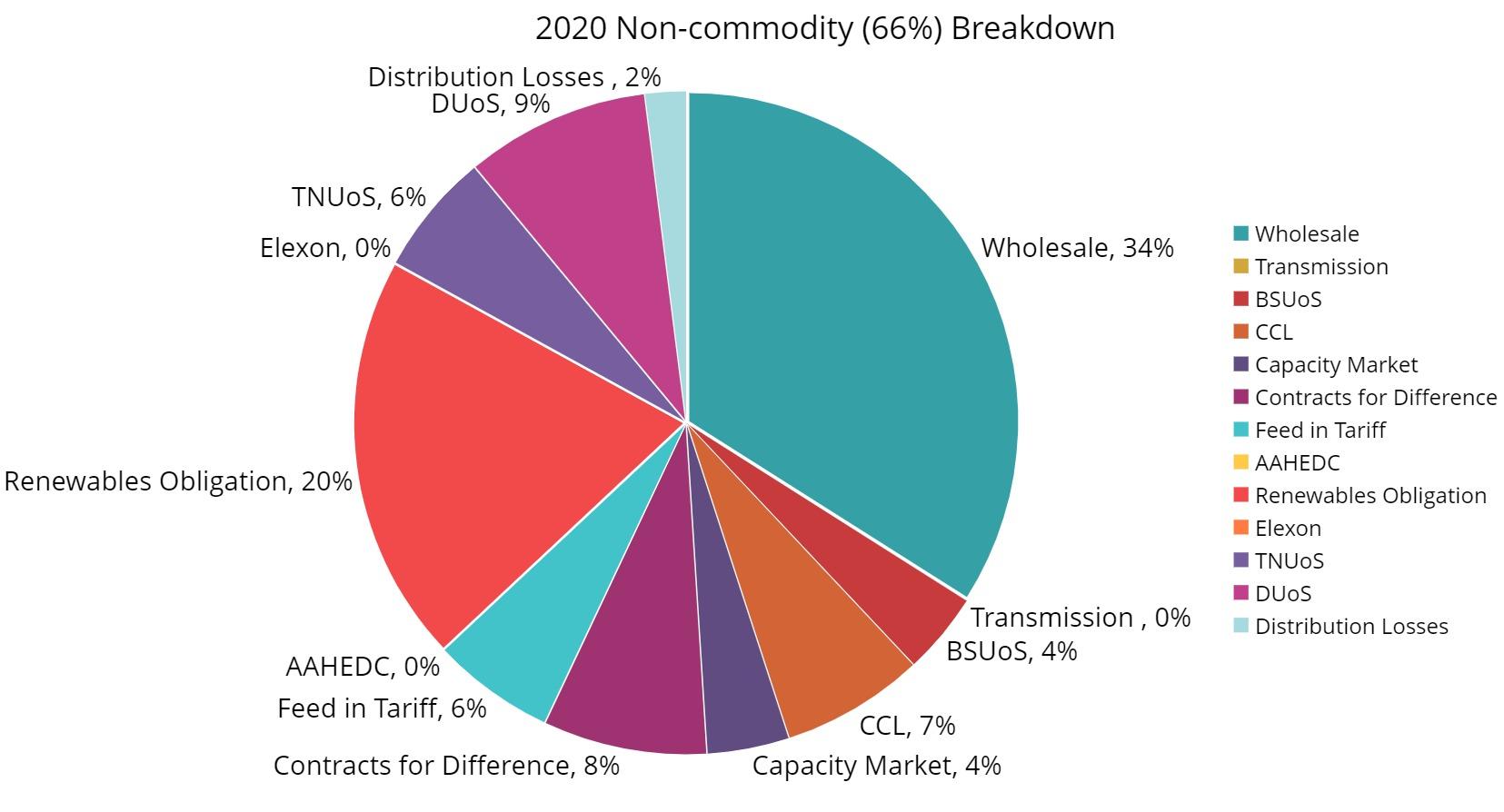

The rise in non-commodity has a bigger impact on electricity bills as it makes up for over 60% as of 2020. We can see this sharp increase over the last three decades and where the costs are going:

The UK lockdowns have seen a large decrease in demand for energy as large consumption businesses were part or fully closed. This decreased caused a reduction in cost for energy but this affect was not very noticeable as the increase in non-commodity cancelled out this reduction. The energy market is also expected to increase bills further to make a rebound to recover lost revenue.

Non-commodity charges can be generally put into categories which are as follows:

Renewable Subsidies – These are to support the funding of government projects which support renewable sources and can be impacted by demand and inflation.

Use of System Costs (DUoS or LC14) – These are to use the transmission network, local distribution network, and national grid to transport your energy and to manage supply and demand.

Taxes and Support Levies – These are taxes, VAT, and other third-party support systems such as the Climate Change Levy which applies to everyone.

More information is available by speaking to Jason Thackray on 0333 9000 246 or email :

jason.thackray@utilityswopshop.co.uk